Asia's

Only Integrated Showcase for Mobility Innovation Across Air, Land and Sea >

MobilityNews >

Helicopter growth holds steady in Asia Pacific

Helicopter growth holds steady in Asia Pacific

Helicopter growth holds steady in Asia Pacific

INDUSTRY SPOTLIGHT | 15 SEPTEMBER 2021

Despite the severe economic and social impact of COVID-19 pandemic felt around the world, recent data in Asia illustrates a profound resilience in the region. Growth expectations over the next decade are not only still intact, but the region’s enviable pre-pandemic economic outlook, supported by massive demographic tailwinds and strong forecasts for regional corporate expansion plans, remains very much in play and will continue to propel the region forward to 2030.

The Asia Pacific region will drive global economic growth over the next decade. By the end of the decade, Asia Pacific’s economy is expected to reach US$45.8 trillion and represent more than 40% of the global total. Not only is Asia Pacific the largest region, but it is also forecast to outgrow the rest of the world at 3.5% per annum.

Underpinning this is the growth of several powerhouse economies. Asia Pacific expects to house three of the four largest economies in 2030, China, India, and Japan, with Australia, South Korea and Indonesia also included in the top 15.

Against this backdrop, the demand for helicopters within the Asia-Pacific region will follow in several areas. The demand for energy to meet this increase will come from traditional sources such as oil and gas in the region, feeding into their local economies, in countries such as Australia, Indonesia, Malaysia, Thailand and China. The demand for wind energy in the region is growing with large projects planned in Taiwan, South Korea, China, and Japan, which will require helicopter support.

The middle class in the region will also lead to an increase in demand for HEMS. There is already an established HEMS network in Australia, Japan and South Korea have large government-funded programmes, and in New Zealand operate charity funded services. The demand for HEMS services will increase across the region in the coming years, prime countries being Malaysia, Thailand, and Indonesia. China has yet to establish a significant HEMS operation, despite several attempts to start up service within the private sector.

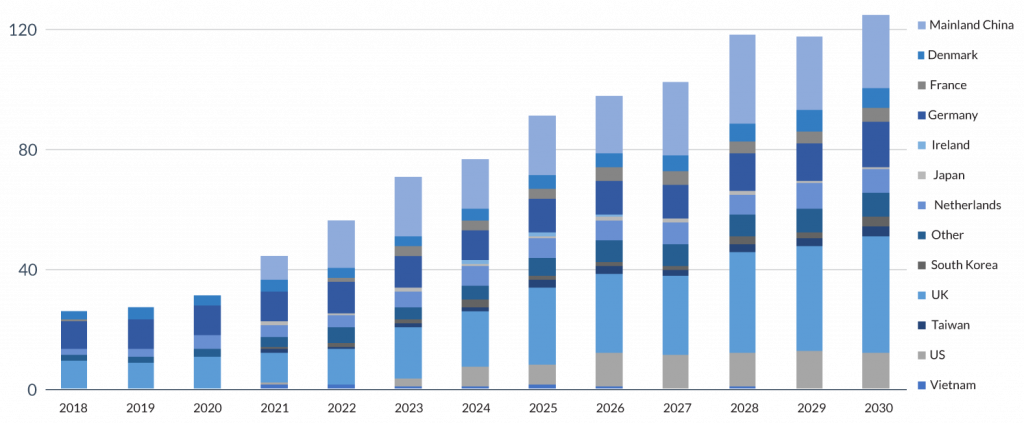

Data from Asian Sky’s 2020 Civil Helicopter Fleet Report indicates there were 4,385 civil turbine helicopters in operation in the Asia Pacific region at the end of 2020. The fleet grew by 78 types in 2020, a year-on-year growth rate of 1.8% from 4,307 units at the end of 2019. Despite the impact of COVID-19 on the global economy, the helicopter fleet is forecast to continue a growth rate of around 0.5% this year.

Nearly 100 additional helicopters will be required by 2030

Photo credit: Asian Sky Fleet Report 2020

Australia remains the largest market – with a fleet of 865 operational civil turbine helicopters at the end of last year. Mainland China, Japan, New Zealand, and India followed, with 773, 673, 541 and 288 helicopters respectively. Combined, the top five countries, in terms of fleet size, accounted for more than 70% of the total 4,385 turbine helicopters in service.

According to Chris Lloyd, VP Marketing for Asia helicopter lessor LCI western OEMs such as Leonardo, Airbus Helicopters and Bell Helicopters will likely be the dominant players in the region. Leonardo’s range of medium-sized and twin-engine types such as the AW169, AW139 and AW189 will likely be in high demand for the offshore energy sector. Airbus’ offerings for this market will likely be the H145, H160 and H175, whilst will enter the sector with the Bell 515, once it is fully certified and ready to begin deliveries.

In the HEMS market, the dominant types will be the AW109SP, AW169 from Leonardo, the H135 and H145 from Airbus and the Bell 429 from Bell.

There is also the large corporate/VIP segment of the market that the OEMs serve, as well as the utility single-engine segment, which is dominated by Airbus with the H125/H130 series and Bell’s 505 and 407.

Unlike other regions, Russian helicopters have proved popular in the region for heavy lifting and firefighting duties, and the robust Mil Mi-17 and to some degree the Kamov KA-31 continue to be used by several countries in significant numbers in the region. As heavy western types such as the H225 and S-92 enter the final years of their service, we may see more Russian types entering the large utility market. But, Vincenzo Alaimo, VP – Asia-Pacific Global Sales at Leonardo foresees a shift to the super-medium category and more opportunities for dual-use aircraft for particularly for parapublic and military customers. Leonardo sees their AW149 as the perfect fit in this category, as it already has an active market and has proven itself capable of delivering high payloads at long range at a lower operational cost than larger and heavier platforms. Alaimo believes the four-to-six-ton category will have the most growth within the Asia-Pacific region.

No matter what type of class of helicopter begins its operating service within the Asia-Pacific region, its success and reputation will rest on the support the OEMs can provide. If the supply network chain stretches back to Europe or the US, then it’s likely the type won’t remain in service for too long.

To counter this problem all the helicopter OEMs have been investing heavily in the region for several decades, Airbus Helicopters has had a presence in Southeast Asia since the 1970s, as has Bell Helicopters. Recently, Leonardo has also set up local MROs with full capability (Leonardo Malaysia). The OEMs have long-established presences in China, South Korea, and Japan, either directly through subsidiaries or with local appointed MRO partners. Similarly in Australia, the OEMs have a strong presence and have had for many decades. To sum up, with optimism. Due to the forecasted regional economic growth combined with a fast-growing population and middle class, there will be increasing opportunities across all sectors of the helicopter industry

By: Glenn Sands, Editor

Article | RotorHub